The Ultimate Personal Finance Money Management System

On our path to early retirement, one of the things not spoken about is money management.

Knowing what to invest in is great but is useless unless we actually have money to invest.

In this article, I talk about how I manage my monthly salary, not just for investing but more:

50% of my monthly salary is budgeted for necessities, bills, and a bunch of other categories.

17% of my monthly salary is used for investing, which in my case is invested in index funds.

17% of my monthly salary is used for saving for spending such as for holidays, gifts, car, etc.

17% of my monthly salary is for paying off debt such as for overpaying loans, mortgage, etc.

In this article, I explain my management process in further detail including all of my accounts.

I demonstrate it by giving an actual worked example, such as for a couple sharing expenses.

Finally, I compare my approach to other strategies when it comes to money management.

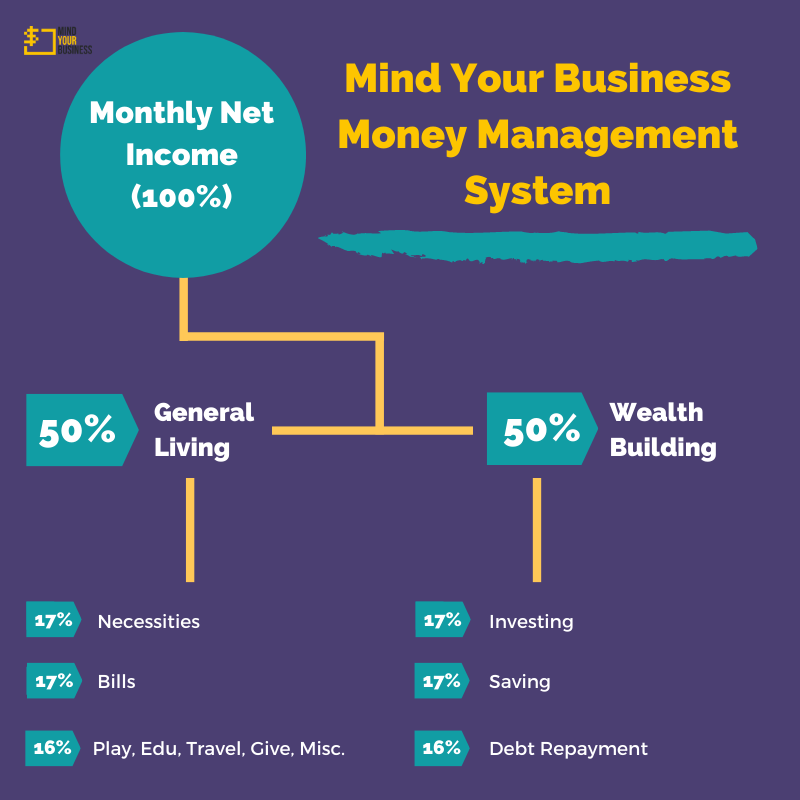

MYB Money Management System

I’ll start with an overview of the MYB Money Management System. It goes as follows:

- 50% of your monthly income goes towards General Living: essentials, bills, miscellaneous etc.

- 50% of your monthly income goes towards Wealth Building: investing, saving, debts, etc.

This method is aimed towards couples but can also apply if you have one income source.

The first thing to note is we’ve assigned 50% of our total monthly income for General Living.

In other words, this means that we aim to live off only 50% of our combined income. Why?

Because should one of us lose our jobs, it won’t affect our lifestyle, only our wealth building.

So for example, let’s say that a couple makes £6,000 combined net monthly income.

That means that £3,000 would be assigned for General Living and £3,000 for Wealth Building.

But the next question is: what does General Living and Wealth Building actually consist of?

Part 1: General Living

Within the General Living Category, the MYB system breaks down the income even further:

- 33% for Necessities: This is essential variable monthly spending: food, transport, etc.

- 33% for Bills: This is essential fixed monthly bills: rent/mortgage, utilities, internet, phone etc.

- 33% for Other: The remaining is spent anything else you want: eating out, miscellaneous, etc.

Unlike other money management systems, this method factors in money to be spent on fun!

So, from our £6,000 monthly income, we said £3,000 would be assigned for General Living.

Of that £3,000; £1,000 would be issued for Necessities, £1,000 for Bills, and £1,000 for Other.

You may be thinking: only £1,000 for bills? My bills are way more than that. That’s totally fine.

What I would do is then combine your necessities and bills so that in total it adds up to £2,000.

That way, in this example, you would still have £1,000 (33%) to spend on everything else.

General Living: Further Breakdown

The MYB system breaks down the Other of General Living into the following 5 categories:

- 20% for Play: This is guilt free money assigned for what fun things you want to do that month.

- 20% for Education: This is money assigned for personal development: books, courses, etc.

- 20% for Travel: This is money assigned for travel expenses outside of work commuting.

- 20% for Giving: This is guilt free money not just for donations, but for gifts for other people.

- 20% for Miscellaneous: This is money assigned for things that don’t fall into another category!

So, continuing with our example, we said that we have £1,000 allocated for other spending.

Therefore: £200 for Play, £200 for Educate, £200 for Travel, £200 for Giving and £200 for Misc.

The idea with this is that you have guilt free money to spend on things that make you happy.

Now that we have talked about General Living in detail, we can now discuss Wealth Building.

Part 2: Wealth Building

The last part of the MYB Money Management System is Wealth Building which comprises of:

- 33% for Investing: this is money allocated just for investing in stocks, property, business, etc.

- 33% for Savings: this is money for inevitable long term big purchases i.e. holidays, car, etc.

- 33% for Debt Payment: this is for paying off any debts you have i.e. credit cards, loans, etc.

A lot of management systems say to invest all of your spare income, but I find this unrealistic.

Coming back to our example we said that of the £6,000 income; £3,000 is for Wealth Building.

That means that £1,000 is for investing, £1,000 is for saving, and £1,000 is for debt payment.

A lot of money management systems will tell you to build what’s called an emergency fund.

It is a savings account with up to 6 months’ worth of living expenses in case of emergencies.

The money in Savings can be used as an emergency fund without having to go into more debt.

Done is Better than Perfect

As shown, the MYB Money Management System is not just for assigning money for investing.

It’s a complete money management system to manage all of your monthly income/expenses.

However you may be thinking: “That sounds great but I can’t live off only 50% of my income.”

That’s totally fine - these are just guidelines, ideal percentages to aim towards over time.

The MYB system places a huge importance on Wealth Building which is why it is at 50%

However if you can only have General Living at 60% and Wealth Building at 40% that’s fine.

Do what works for you, have a starting point - you can always adjust and improve as you go.

You may also be thinking: “That’s great for this fictional couple, but I don’t make that much.”

That’s alright, work with what you have, and use the percentages to distribute your income.

As your income grows over time, you’ll have developed a great money management system.

---

To find out more about early retirement, check out our articles on retirement and investing.

Do you know what your FIRE Score is? Take our FIRE Quiz to see how close you are to FIRE.

Are you on the path to early retirement? How is it going? Feel free share in the comments!

To get the latest tips early retirement, make sure to subscribe to the MYB Retirement Club.

Hi, my name is Bishoy. I am a Designer, Blogger, and Entrepreneur. Join me as I document my thoughts, ideas, and findings within the world of Entrepreneurship, Investing, and Personal Finance.

Originally written on mindyourbusiness.bz