Paycheck Automated Budget - Budgeting Series Part 2

Automate your budget!

How to automate at the paycheck level

Please review Budgeting Series Phase 1 for the setup and foundation. The following three posts, including this one, will be different types of budgets you can use. Each is meant to be a way to use the budget that fits your personality.

Now that you’ve read that, I wanted to start with, I think, the simplest and most automated form of budgeting. This doesn’t mean there will be zero work. There will be some upfront work, and you must think strategically, but once it is set, it just takes minor tweaks.

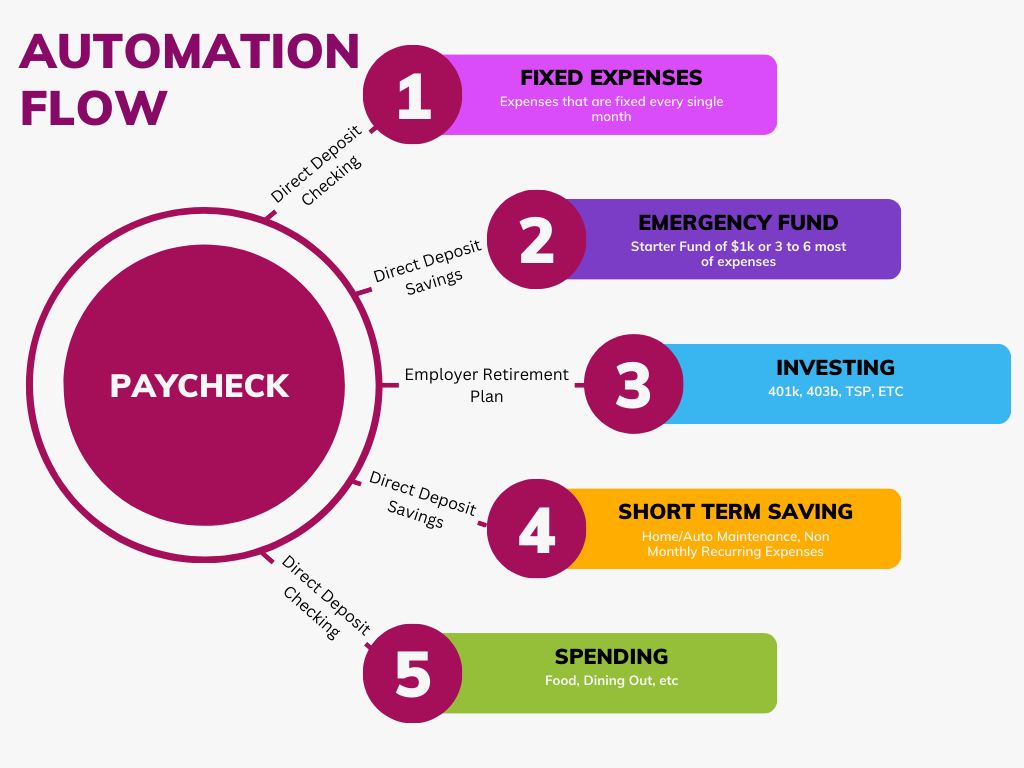

There are Five categories I think through when automating my budget.

- Fixed Expenses

- Emergency Fund

- Investing

- Short Term Saving

- Spending

The goal is to automate all five of these at the paycheck level. This should be simple to do at your employer. Most employers allow 401ks or some equivalent and up to 5 direct deposit accounts. This is how we will automate our budget. If, for some reason, you don’t have access to these things, that’s okay. You will have one incoming account (think one extra checking account) and auto-transfer money from there.

Fixed Expenses

These are bills that happen every month and have fixed amounts. You will total up what these would be and deposit this much plus a little more every paycheck, and all your bills will be set to autopay. You add a little buffer for the weird things, like an increase you weren’t expecting, etc. I like to have at least a one month buffer in this account. If you don't have it at first, that's okay, but you can work overtime incrementally to get there. It will help give you piece of mind when you set everything up on auto payments. I put this in a checking account.

Emergency Fund

Add the paycheck amount you want to put toward your emergency fund. When it’s fully funded, turn off the direct deposit. I usually like to put this into a savings account.

Investing

We are talking about the automated budget. So it may not be the most “optimal,” but it still will be terrific. Just contribute to the 401k at your employer until it’s maxed out. If you don’t have an employer retirement option (or not a good one) or maxed out your contributions, you put funds in the one incoming account and distribute them to your IRA, etc.; from there, if you can’t do it at the paycheck level.

Short Term Saving

This can be done in multiple ways. The easiest way is to set up a checking account and distribute your nonmonthly expenses here. These are maintenance funds and expenses that reoccur non-monthly. And set up everything to come from this account. You could also set up a checking account for your reoccurring non-monthly costs and have a savings account(s) for your maintenance funds. The simplest is just to put it all in one savings account.

Spending

Then, last, you have a checking account for your spending. You could use your debit card or take out cash, which you have to spend for food and everything else.

In Conclusion

This is a great automated way to set up your budget. I like this method, and had I found it when I was younger, I would have used it first.

Disclaimers

As an Amazon Associate, I earn from qualifying purchases and other links, but not all.

This article is informational; it should not be considered Health, Financial, or Legal Advice. Not all information will be accurate. Consult health, financial, or legal professionals before making any significant decisions.

Books, Credit Cards, Software, and Products I recommend

Follow me on LinkedIn.

Suppose you want to ask me a question or reach out to me. You can contact me here.

Updated 1/2/24